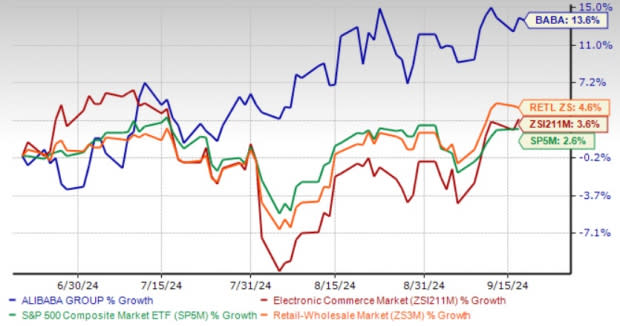

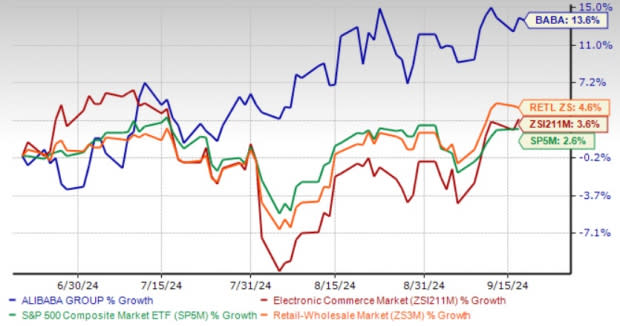

Alibaba BABA shares have gained 13.6% previously three months, outperforming the Zacks Internet-Commerce business’s return of three.6%, the Zacks Retail-Wholesale sector's rise of 4.6% and the S&P 500’s rally of two.6%.

The firm has been benefiting from strong momentum within the Alibaba International Digital Commerce Group (“AIDC”) enterprise, which is comprised of Lazada, AliExpress, Trendyol, Alibaba.com, and different companies working within the worldwide retail and wholesale markets.

BABA’s strategic investments and a deepening deal with the innovation of services and products with the ability of AI are taking part in an important function in shaping the expansion trajectory of the corporate.

Three-Month Price Performance

Image Source: Zacks Investment Research

Uncertainties within the international surroundings, altering consumption patterns, recessionary fears, market volatility and difficult situations in China's economic system don't bode nicely for BABA inventory.

Escalating tensions between the United States and China are regarding. Although this geo-political tech conflict isn't immediately associated to the e-commerce business, its residual impact doesn't bode nicely for Alibaba and different related corporations.

Although Alibaba is the dominant e-commerce participant in China, its international place stays underneath menace from bigwigs like Amazon AMZN and eBay EBAY.

Given the mix of each dangers and rewards, traders ought to rigorously weigh Alibaba’s progress prospects towards the challenges it faces.

AIDC Strength Boosts Alibaba’s Prospects

Solid momentum in AliExpress, Trendyol and Alibaba.com has been benefiting the abroad e-commerce enterprise considerably. Growing investments in key markets are serving to enhance the model recognition of AliExpress and Trendyol.

Alibaba’s increasing cross-border retail and logistics operations are main positives.

Strength in AliExpress Choice is driving progress inside the enterprise. Its initiative of upgrading the supply-chain service has resulted within the transition from the unique platform enterprise mannequin to a supply-chain-driven platform market mannequin, which provides semi-consignment and full-consignment providers.

Alibaba expanded the provider base on the AliExpress platform, which now consists of native retailers, so as to improve its product choices and meet native customers’ calls for seamlessly. Alibaba’s partnership with Magazine Luiza, a number one retailer in Brazil, per which the latter will open and function a storefront on AliExpress and vice versa, stays noteworthy.

Alibaba’s deepening deal with delivering localized and enhanced person experiences to totally different customers worldwide stays noteworthy. The firm is leveraging AI and different superior applied sciences to enhance effectivity in areas like cross-platform product itemizing, product particulars, multilingual search and focused suggestions.

Alibaba is witnessing a rise within the variety of small and medium-sized enterprises (SMEs) using AI providers on its platform.

The introduction of Alibaba Guaranteed for international SMEs is one other plus. Alibaba Guaranteed is a platform that simplifies B2B cross-border commerce for SMEs by providing supply-chain reliability.

The launch of an inexpensive logistics resolution, particularly Logistics Marketplace, for SMEs within the United States is noteworthy.

Banking on these components and initiatives, there's a substantial upward potential within the AIDC enterprise, which has turned out to be the important thing catalyst for Alibaba.

Growing Estimates Paint Bright Picture for BABA

Alibaba’s long-term prospects are anticipated to learn from its strong worldwide commerce enterprise and robust AI integrations.

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $139.56 billion, indicating 7% year-over-year progress.

The Zacks Consensus Estimate for fiscal 2025 earnings is pegged at $8.68 per share, indicating a year-over-year rise of 1%. The determine has been revised upward by 5.9% over the previous 60 days.

Image Source: Zacks Investment Research

Solid Liquidity Supports BABA’s Shareholder-Friendly Initiative

Alibaba’s sturdy steadiness sheet and strong money movement producing capability are noteworthy. As of June 30, 2024, the corporate had a robust internet money place of RMB 405.75 billion or $55.8 billion. The free money movement was RMB 17.4 billion or $2.4 billion. Solid money movement technology permits Alibaba to return within the mixture of share repurchase and dividend funds to its shareholders.

In the quarter ended June 30, 2024, it repurchased 613 million abnormal shares (equal to 77 million ADSs) for $5.8 billion within the United States and Hong Kong markets underneath its share repurchase program.

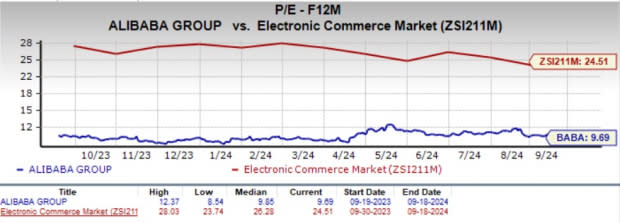

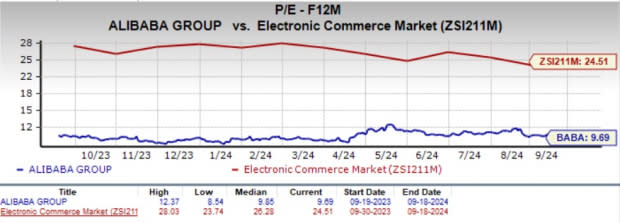

Attractive Valuation: A Silver Lining for BABA

Alibaba is at the moment buying and selling at a reduction with a ahead 12-month Price/Earnings of 9.69X in contrast with the business’s 24.51X and decrease than the median of 9.89X. This signifies a strong alternative for traders.

It additionally has a Value Score of A, which is difficult to disregard.

Image Source: Zacks Investment Research

Final Note

Alibaba’s power in its worldwide commerce enterprise and main place in China's e-commerce house, together with rising estimates, enticing valuation and strong liquidity, current a compelling funding alternative.

However, macroeconomic uncertainties, softness in China and stiffening competitors within the international e-commerce market don't bode nicely for the BABA inventory.

To conclude, traders eager about Alibaba ought to watch for a greater entry level, contemplating uncertainties surrounding its prospects. BABA at the moment has a Growth Score of C, which isn't a good indicator.

However, those that already personal this Zacks Rank #3 (Hold) inventory could keep invested as the corporate's long-term prospects are strong. You can see the entire record of at present’s Zacks #1 Rank (Strong Buy) shares right here.

Want the most recent suggestions from Zacks Investment Research? Today, you may obtain 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report