Analysts and traders are keenly observing the inventory efficiency of JPMorgan Chase & Co JPM and Wells Fargo & Co WFC forward of their third-quarter earnings stories on Oct. 11.

Both banks are showcasing robust technical indicators, however which inventory charts a extra bullish path?

JPMorgan Chase: Strong Bullish Signals

JPMorgan is anticipated to report earnings of $4.01 per share on revenues of $41.66 billion. The inventory is at present priced at $213.42, barely above its analyst consensus goal value of $207.17. Consensus analysts ranking for JPMorgan inventory stands at Overweight.

Recent rankings from Oppenheimer, Morgan Stanley, and Deutsche Bank have set a mean value goal of $229.67, suggesting a possible upside of seven.53%.

Chart created utilizing Benzinga Pro

Technical evaluation paints a constructive image for JPMorgan inventory. The share value is comfortably above its eight, 20 and 50-day easy transferring averages (SMAs), indicating robust bullish momentum.

Additionally, with the inventory buying and selling above its 200-day easy transferring common (SMA) of $195.79, a number of indicators level in the direction of a bullish sign.

Wells Fargo: Promising Yet Cautious Outlook

In comparability, Wall Street expects Wells Fargo to ship earnings of $1.28 per share and revenues of $20.4 billion. The present share value stands at $57.54, decrease than the consensus goal of $59.80. Consensus analysts ranking for Wells Fargo inventory stands at a Neutral.

However, latest rankings from Wolfe Research, Evercore ISI Group, and Morgan Stanley venture a mean goal of $66.67, hinting at a extra substantial upside of 15.86%.

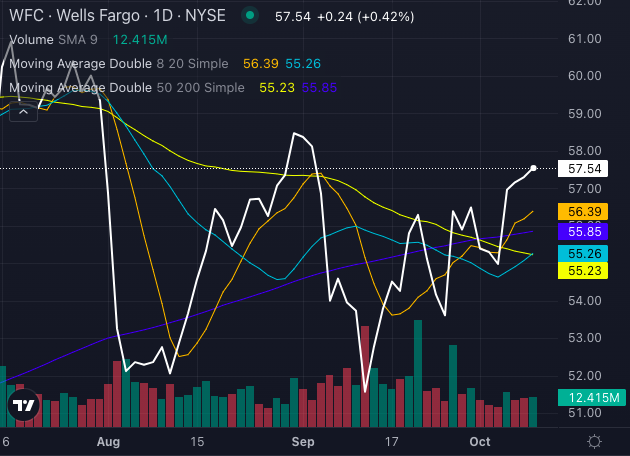

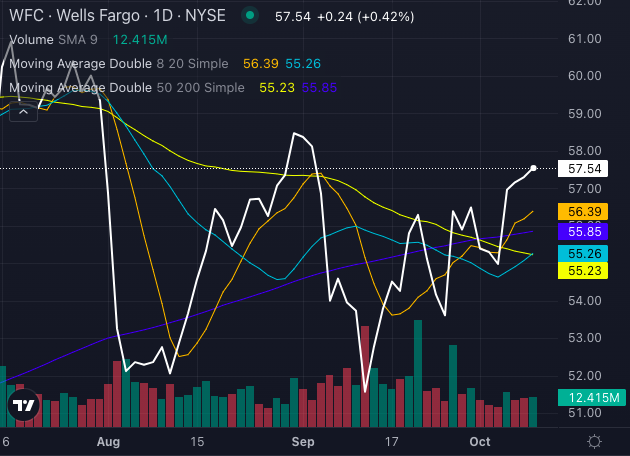

Chart created utilizing Benzinga Pro

Wells Fargo inventory’s technical indicators are additionally encouraging. The inventory value is comfortably above its eight, 20 and 50-day SMAs, with bullish alerts confirmed throughout these indicators.

The present value exceeds its 200-day SMA of $55.85, reinforcing the bullish sentiment within the brief time period.

Read Also: How To Earn $500 A Month From Wells Fargo Stock Ahead Of Q3 Earnings

The Verdict

Both JPMorgan and Wells Fargo show bullish traits of their inventory charts. New York-based JPMorgan seems to have a stronger technical edge with higher analyst rankings and a better present inventory value relative to its transferring averages.

Though consensus value goal seems to indicate extra upside with San Francisco-based Wells Fargo.

As each corporations put together to launch their earnings, traders shall be watching intently to see if these bullish developments translate into constructive outcomes.

Indeed, Wells Fargo presents a compelling upside potential. But JPMorgan’s present power in each technical and analyst views could place it because the extra bullish monetary inventory forward of earnings.

Read Next:

Market News and Data delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn't present funding recommendation. All rights reserved.