Stock futures had been barely greater Friday forward of the discharge of U.S. labor market knowledge that Federal Reserve officers shall be watching carefully as they take into account their subsequent transfer on rates of interest.

Futures tied to the Dow Jones Industrial Average had been up 0.1%, whereas these linked to the S&P 500 and Nasdaq 100 gained 0.2% and 0.3%, respectively. The main indexes closed decrease on Thursday because the bumpy begin to October buying and selling continued, whereas oil costs surged amid rising issues about tensions within the Middle East.

Stocks have been in one thing of a holding sample in current days as traders await the September jobs report, due at 8:30 a.m. ET. Fed officers have mentioned they're more and more targeted on the labor market, which has proven indicators of weak spot, now that inflation has moderated. The Fed reduce its benchmark rate of interest final week for the primary time in 4 years and has indicated that extra easing is probably going, although financial knowledge will drive choice on how briskly and deep subsequent cuts shall be.

News that dockworkers late Thursday agreed to droop an enormous strike, which had closed ports from Maine to Texas this week, supplied a lift to sentiment. There had been issues that the work stoppage may may considerably disrupt provide chains, sparking inflation and harming the labor market.

Mega-cap know-how shares had been greater throughout the board in premarket buying and selling Friday. Meta Platforms (META) was up 0.3% and on tempo to hit one other document excessive, whereas Nvidia (NVDA) rose 0.4% after surging greater than 3% yesterday amid optimism about demand for AI. Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL) and Amazon (AMZN) had been additionally greater forward of Friday's opening bell.

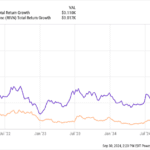

U.S.-traded shares of Chinese shares had been additionally rising, extending large features that had been spurred final week by the announcement of wide-ranging stimulus measures by Chinese authorities. The iShares MSCI China ETF (MCHI) was up practically 4% in premarket buying and selling and is up about 30% for the reason that first batch of measures was introduced early final week.

Crude oil futures had been up about 1% after surging greater than 5% yesterday amid issues {that a} rising battle within the Middle East may reduce into provide.

Gold futures had been little modified at $2,680 per ounce, whereas bitcoin rose about 1% to round $61,300.

Major Index Stock Futures Higher Ahead of Jobs Data

43 minutes in the past

Futures tied to the Dow Jones Industrial Average had been up 0.1%.

TradingView

S&P 500 futures had been up 0.3%.

TradingView

Nasdaq 100 futures had been up 0.4%.

TradingView