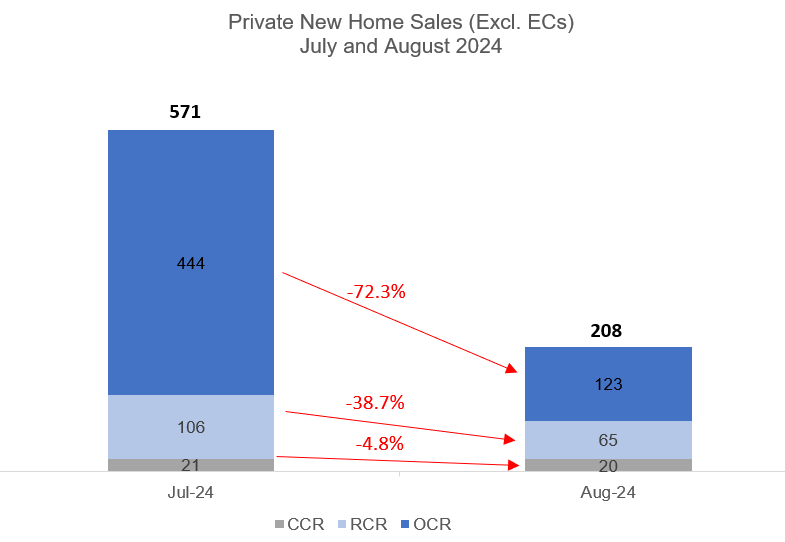

16 September 2024, Singapore – Private new house gross sales declined in August following a powerful rebound in the earlier month. Developers offered 208 new models (ex. govt condos) in August, representing a 64% month-on-month fall from 571 models shifted in July. On a year-on-year foundation, builders' gross sales had been down by about 47% from the 394 models transacted in August 2023. Taken collectively, 2,668 models of new non-public houses (ex. EC) have been offered in the primary eight months of 2024.

There had been no contemporary initiatives launched in August, which coincided with the lunar Ghost Month, a interval that sometimes sees a decrease property gross sales quantity, as folks chorus from transacting and as builders maintain again on placing new initiatives in the marketplace. Developers put out 272 new models (ex. EC) from previously-launched initiatives on the market in August, down from 616 new models launched in July.

In August, the Outside Central Region (OCR) led gross sales, with a number of OCR initiatives among the many best-sellers in the month. New houses gross sales in the OCR made up about 59% of the full transactions in August.

Developers offered 123 new models (ex. EC) in the OCR in August – down by about 72% from July. The OCR accounted for majority of the top-selling non-public residential initiatives through the month (see Table 3). The hottest OCR initiatives included: Hillock Green which transacted 17 models at a median value of $2,108 psf; Lentoria which shifted 15 models at a median value of $2,217 psf; and Hillhaven which offered 14 models at a median value of $2,153 psf. Meanwhile, The Botany At Dairy Farm moved 12 models in August, taking the take-up charge to 97% for the reason that venture was launched in March 2023. The 533-unit Lentor Mansion continued to pare down on its inventory following a profitable launch in March this 12 months; the venture transacted 8 models in August and is now 86% offered.

In the Rest of Central Region (RCR), there have been 65 new houses offered in August, about 39% decrease than the 106 models transacted in the earlier month. The best-selling RCR venture and additionally the highest vendor in August general was Tembusu Grand, which offered 30 models at a median value of $2,455 psf. Based on URA information, Tembusu Grand has transacted 470 out of its 638 models (or 74%) for the reason that venture was launched in April 2023. It is probably going that the upcoming new launch – the 846-unit Emerald of Katong – throughout from Tembusu Grand may have created extra buzz in that space, which had helped to enhance curiosity for Tembusu Grand. The different two RCR initiatives that made it to the highest 10 best-sellers' checklist in August had been The Continuum and The Reserve Residences which offered 10 and 9 models respectively (see Table 3).

Meanwhile, builders offered 20 new models in the Core Central Region (CCR) in August – down marginally from the 21 models transacted in July. Three CCR initiatives accounted for the majority of the gross sales in this sub-market. One Bernam shifted 6 models at median value of $2,799 psf, 19 Nassim and Watten House every offered 5 models at median costs of $3,477 psf and $3,233 psf respectively in August. The priciest new unit offered in August is positioned in the CCR, specifically the 4,198-sq ft freehold property at 32 Gilstead which was bought by a Singapore everlasting resident for $14.7 million (unit value of $3,505 psf) – reflecting the very best value quantum and unit value achieved among the many 4 transactions at 32 Gilstead, for the reason that venture was launched in April 2024.

In the EC phase, builders offered 36 new models in August, down by 2.7% from the 37 new EC models transacted in July. North Gaia EC in Yishun made up a lion's share of the gross sales, with 24 models offered at a median value of $1,306 psf. Amid the paring down of EC inventory, there at the moment are round 200 models of unsold new EC in the marketplace, and the tight provide ought to bode nicely for the following EC venture that will come on later this 12 months, being the 504-unit Novo Place EC in Plantation Close in Tengah.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty stated:

“New homes sales were once again sluggish in August, after transactions rebounded in July. The weaker sales volume was mainly due to a lack of new projects being launched, as well as the seasonal lull owing to the lunar Ghost Month. We anticipate that developers' sales in September could see some slight improvement with the upcoming launch of the 158-unit 8@BT, which is within walking distance to the Beauty World MRT station. Beyond September, other launches that could potentially come on include Meyer Blue, Union Square Residences, Bagnall Haus, Emerald of Katong, Nava Grove in Pine Grove, Norwood Grand in Champions Way, the Chuan Park, Aurea in Beach Road, and the mixed-use project to be built on the Marina View white site.

Despite the decline in developers' sales in August, we note that the overall median transacted price of new non-landed private homes increased by 42% to nearly $2.4 million in August from about $1.7 million in the previous month (see Table 1), according to caveats lodged. The lower transaction volume could have affected prices in August. Meanwhile, there was also a higher proportion of units sold at higher price levels during the month, which had helped to boost overall prices in August.

Table 1: Median transacted price of new non-landed private homes sold by Month (ex, EC)

Core Central Region | Outside Central Region | Rest of Central Region | Overall | |

Jan-24 | $3,503,400 | $1,927,415 | $2,011,956 | $2,005,000 |

Feb-24 | $2,663,808 | $1,987,000 | $2,412,000 | $2,332,500 |

Mar-24 | $3,124,000 | $1,746,000 | $2,869,500 | $1,851,895 |

Apr-24 | $3,118,000 | $2,114,000 | $2,386,000 | $2,249,000 |

May-24 | $2,814,000 | $2,109,500 | $2,092,500 | $2,162,031 |

Jun-24 | $3,635,800 | $2,088,000 | $2,288,000 | $2,222,310 |

Jul-24 | $2,453,000 | $1,497,500 | $2,750,000 | $1,682,000 |

Aug-24 | $3,668,000 | $2,169,430 | $2,920,000 | $2,390,000 |

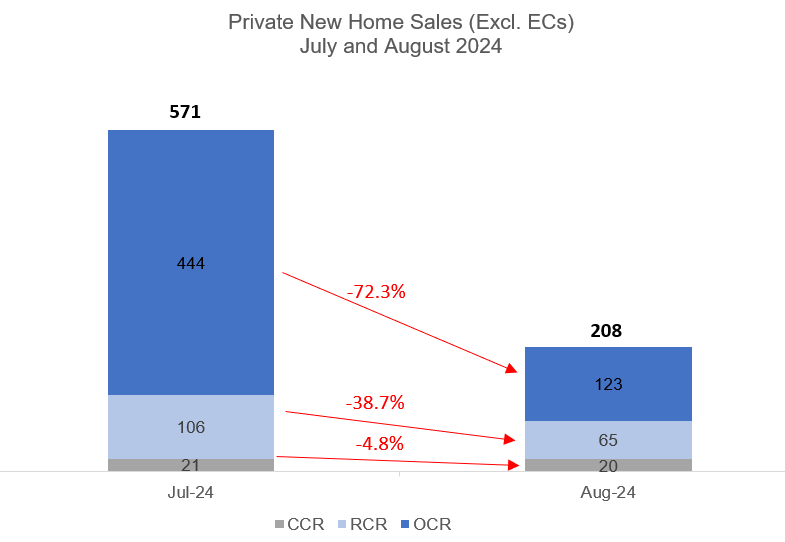

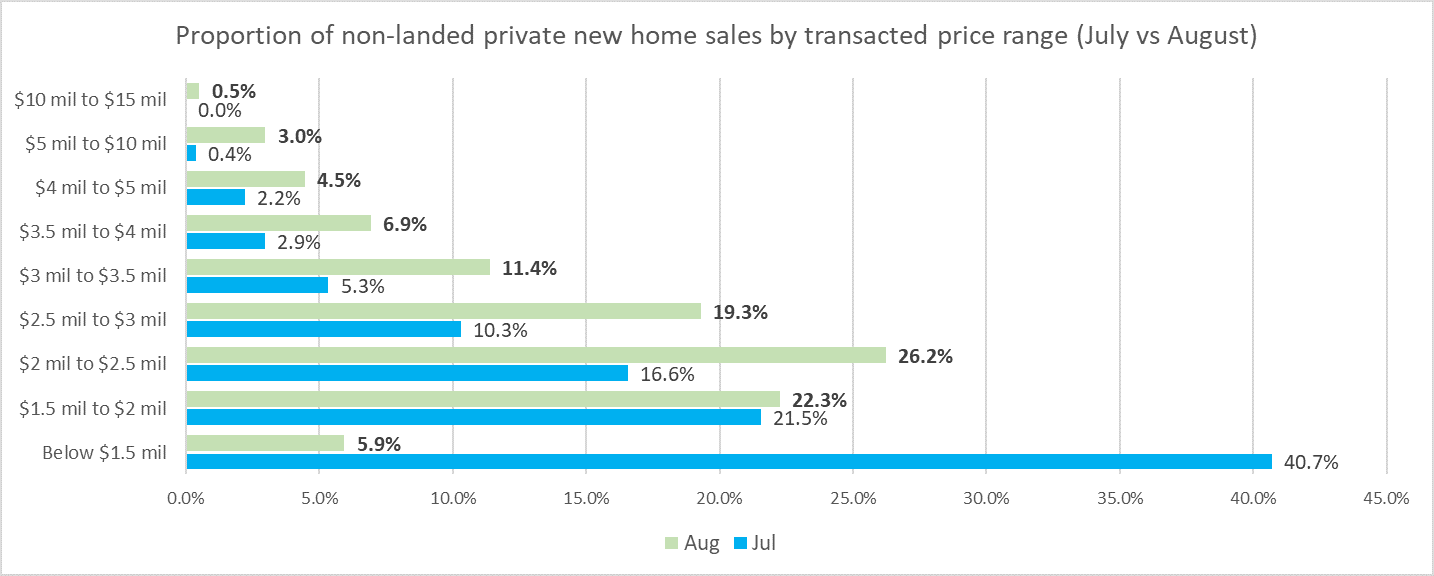

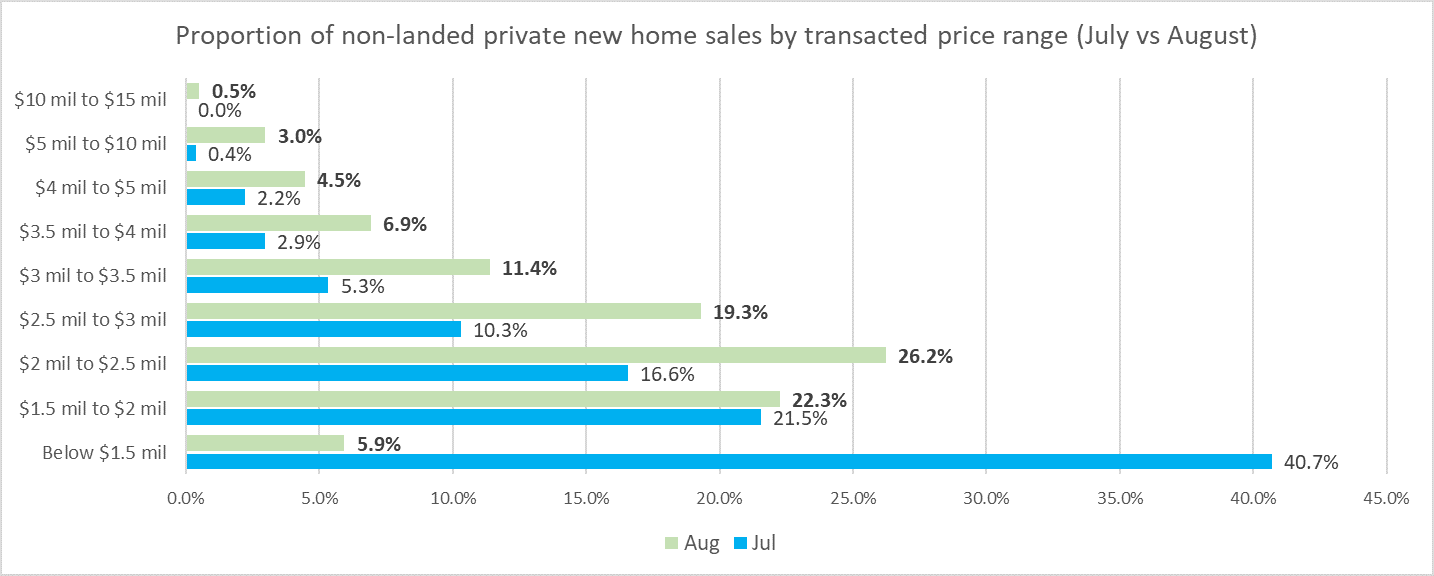

Notably, about 41% of the new non-landed private homes sold in July 2024 were priced at below $1.5 million – largely contributed by new launches Sora and Kassia – compared with the 5.9% proportion in August (see Chart 1). We note that transacted prices were higher across the other price bands in August, based on our analysis of the URA Realis caveat data.

This could be due to a dearth of new projects in August which had influenced the price trend during the month. Meanwhile, the new projects that came on in July would have affected pricing, as fresh launches tend to have a wider availability of smaller units which are transacted at a lower price quantum. For instance, caveat data showed that about 59% of the non-landed new private homes sold in July have a unit size of 800 sq ft or below, while about 24% of August's sales were similarly sized.

Chart 1: Proportion of non-landed private new home sales (ex. EC) by transacted price range

Meanwhile, the proportion of new non-landed private homes (ex. EC) purchased by foreigners (non-PR) made up 2.5% of August's transactions – marking an increase from the 0.9% in July. However, in absolute terms the number of transactions by foreigners (NPR) is similar in July and August, at 5 transactions each month. Singapore PRs accounted for 8.9% of the transactions, while the proportion of non-landed private new home sales to Singaporean buyers rose to 88.1% in August from about 87.1% in the previous month (see Table 2).

Table 2: Proportion of non-landed new private home sales (ex. EC) by nationality by residential status by month

Nationality by Residential Status | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Jan-24 | Feb-24 | Mar-24 | Apr-24 | May-24 | Jun-24 | Jul-24 | Aug-24 |

Company | – | – | – | – | – | – | – | – | – | – | – | 0.2% | 0.5% |

Foreigner (NPR) | 2.8% | 5.4% | 6.2% | 1.9% | 3.6% | 0.7% | 2.0% | 1.6% | 3.3% | 2.4% | 5.2% | 0.9% | 2.5% |

Singapore Permanent Residents (PR) | 16.8% | 11.9% | 10.3% | 12.4% | 9.4% | 10.2% | 14.2% | 6.2% | 13.8% | 14.6% | 13.2% | 11.8% | 8.9% |

Singaporean | 80.4% | 82.7% | 83.5% | 85.7% | 87.0% | 89.1% | 83.8% | 92.3% | 82.9% | 83.0% | 81.6% | 87.1% | 88.1% |

Overall, new private home sales year-to-date have been relatively modest amid limited major launches. Homebuyers have become more discerning and are drawn to projects with a lower price quantum. With a steady pipeline of launches still to come – including projects with a sizable number of units – there will be buying opportunities. In addition, the keenly awaited US Federal Reserve policy rate cut, which could happen as early as this week (FOMC meeting on 17-18 September) may help to lighten debt burden and make borrowing more affordable if it comes to pass.

A rate cut should help to lift sentiment somewhat, and could also potentially encourage some property buyers on the sidelines to return to the market. Meanwhile, the improved economic prospects and the still tight labour market are also supportive of the property segment. All things considered, we remain relatively optimistic about new home sales in the last few months of 2024.”

Table 3: Top-Selling Private Residential Projects (ex. EC) in August 2024

S/N | Project | Region | Units offered in Aug 2024 | Median value in Aug 2024 ($PSF) |

1 | TEMBUSU GRAND | RCR | 30 | $2,455 |

2 | HILLOCK GREEN | OCR | 17 | $2,108 |

3 | LENTORIA | OCR | 15 | $2,217 |

4 | HILLHAVEN | OCR | 14 | $2,153 |

5 | LENTOR HILLS RESIDENCES | OCR | 13 | $2,148 |

6 | THE BOTANY AT DAIRY FARM | OCR | 12 | $2,078 |

7 | THE CONTINUUM | RCR | 10 | $2,868 |

8 | THE RESERVE RESIDENCES | RCR | 9 | $2,566 |

9 | THE MYST | OCR | 8 | $2,004 |

LENTOR MANSION | OCR | 8 | $2,185 | |

10 | SCENECA RESIDENCE | OCR | 7 | $2,079 |

POLLEN COLLECTION | OCR | 7 | $2,261 |