Key Insights

- Institutions' substantial holdings in Lumen Technologies implies that they've important affect over the corporate's share value

- 50% of the enterprise is held by the highest 14 shareholders

- Recent purchases by insiders

A take a look at the shareholders of Lumen Technologies, Inc. (NYSE:LUMN) can inform us which group is strongest. We can see that establishments personal the lion's share in the corporate with 66% possession. That is, the group stands to learn probably the most if the inventory rises (or lose probably the most if there's a downturn).

And final week, institutional traders ended up benefitting probably the most after the corporate hit US$6.4b in market cap. The features from final week would have additional boosted the one-year return to shareholders which presently stand at 288%.

In the chart under, we zoom in on the totally different possession teams of Lumen Technologies.

View our newest evaluation for Lumen Technologies

What Does The Institutional Ownership Tell Us About Lumen Technologies?

Institutions usually measure themselves in opposition to a benchmark when reporting to their very own traders, in order that they typically turn into extra enthusiastic a couple of inventory as soon as it is included in a significant index. We would anticipate most corporations to have some establishments on the register, particularly if they're rising.

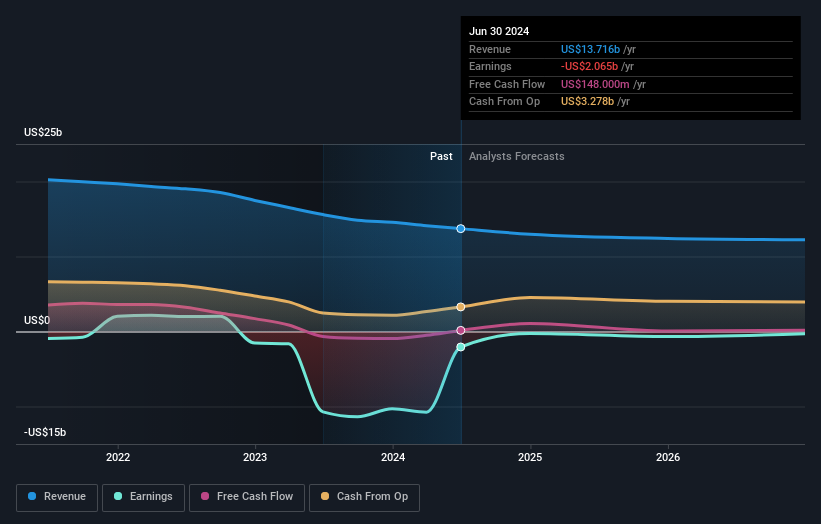

As you'll be able to see, institutional traders have a good quantity of stake in Lumen Technologies. This implies the analysts working for these establishments have seemed on the inventory and so they prefer it. But identical to anybody else, they might be unsuitable. When a number of establishments personal a inventory, there's at all times a threat that they're in a ‘crowded commerce'. When such a commerce goes unsuitable, a number of events could compete to promote inventory quick. This threat is increased in an organization and not using a historical past of development. You can see Lumen Technologies' historic earnings and income under, however preserve in thoughts there's at all times extra to the story.

Since institutional traders personal greater than half the issued inventory, the board will possible have to concentrate to their preferences. We word that hedge funds haven't got a significant funding in Lumen Technologies. Our information exhibits that BlackRock, Inc. is the biggest shareholder with 15% of shares excellent. The Vanguard Group, Inc. is the second largest shareholder proudly owning 12% of widespread inventory, and State Street Global Advisors, Inc. holds about 6.0% of the corporate inventory. Furthermore, CEO Kathleen Johnson is the proprietor of 0.9% of the corporate's shares.

A better take a look at our possession figures means that the highest 14 shareholders have a mixed possession of fifty% implying that no single shareholder has a majority.

While finding out institutional possession for an organization can add worth to your analysis, additionally it is a superb follow to analysis analyst suggestions to get a deeper perceive of a inventory's anticipated efficiency. There are an inexpensive variety of analysts overlaying the inventory, so it could be helpful to seek out out their mixture view on the long run.

Insider Ownership Of Lumen Technologies

The definition of an insider can differ barely between totally different international locations, however members of the board of administrators at all times depend. Company administration run the enterprise, however the CEO will reply to the board, even when she or he is a member of it.

Insider possession is constructive when it indicators management are considering just like the true homeowners of the corporate. However, excessive insider possession may give immense energy to a small group throughout the firm. This will be detrimental in some circumstances.

Our most up-to-date information signifies that insiders personal some shares in Lumen Technologies, Inc.. The insiders have a significant stake price US$138m. Most would see this as an actual constructive. It is nice to see this degree of funding by insiders. You can verify right here to see if these insiders have been shopping for lately.

General Public Ownership

With a 32% possession, most of the people, largely comprising of particular person traders, have some extent of sway over Lumen Technologies. This measurement of possession, whereas appreciable, might not be sufficient to vary firm coverage if the choice isn't in sync with different giant shareholders.

Next Steps:

It's at all times price enthusiastic about the totally different teams who personal shares in an organization. But to know Lumen Technologies higher, we have to contemplate many different elements. Consider as an example, the ever-present spectre of funding threat. We've recognized 2 warning indicators with Lumen Technologies (not less than 1 which is important) , and understanding them needs to be a part of your funding course of.

Ultimately the long run is most vital. You can entry this free report on analyst forecasts for the corporate.

NB: Figures in this text are calculated utilizing information from the final twelve months, which consult with the 12-month interval ending on the final date of the month the monetary assertion is dated. This might not be per full 12 months annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market daily to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High development Tech and AI Companies

Or construct your individual from over 50 metrics.

Explore Now for Free

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren't meant to be monetary recommendation. It doesn't represent a advice to purchase or promote any inventory, and doesn't take account of your targets, or your monetary scenario. We intention to convey you long-term targeted evaluation pushed by basic information. Note that our evaluation could not issue in the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.