There's little doubt about it: Rivian (NASDAQ: RIVN) inventory has large long-term upside potential. Its present market cap is simply $13 billion — $800 billion lower than its greatest competitor in the electrical car (EV) area, Tesla. With new mass-market models on the best way, we might see Rivian's valuation soar over the approaching years. But how have the shares carried out because the firm went public roughly three years in the past?

High hopes for an upstart EV maker

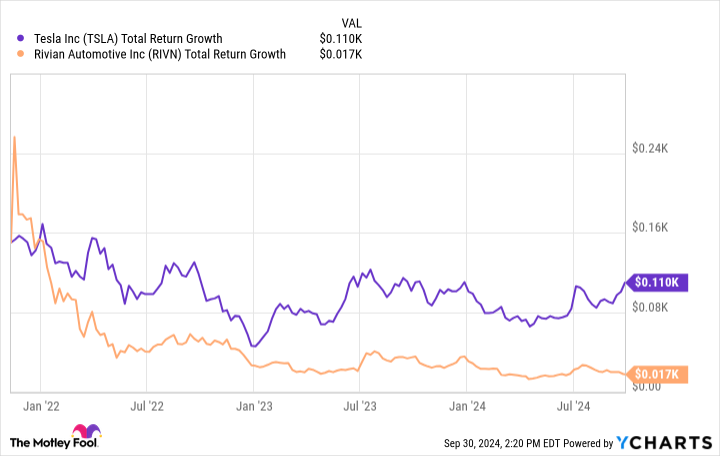

Rivian held its preliminary public providing (IPO) on Nov. 9, 2021, with a value of $78 per share, and closed that first buying and selling day at simply over $100. If you had invested $150 into the corporate when shares first debuted, although, your stake could be value simply $17 in the present day. That's not a typo. In three years, your $150 stake would have shrunk to solely $17.

The downside hasn't been income progress. Over that time-frame, the EV maker's high line has gone from $55 million in 2021 to greater than $5 billion over the previous 12 months. The situation is not its future progress outlook, both. Rivian's new mass-market fashions, that are anticipated to hit the roads beginning in 2026, might assist develop the corporate's gross sales base by an order of magnitude or extra. That's what occurred when Tesla began delivery its mass-market fashions, the Model 3 and Model Y.

What then has been the issue with Rivian inventory? In half, its poor efficiency pertains to the truth that the corporate operates in a capital-intensive and extremely aggressive business. But the bigger situation was a easy overpricing of the inventory. Shortly after it went public, Rivian's market cap peaked at $153 billion — virtually 3,000 instances its 2021 income.

Expectations have come down sharply since then, and even Tesla shares have suffered as a consequence of a slowdown in EV gross sales progress. But for those who're seeking to purchase right into a former progress darling at a traditionally deep low cost, this might be your probability.

Should you make investments $1,000 in Rivian Automotive proper now?

Before you purchase inventory in Rivian Automotive, think about this:

The Motley Fool Stock Advisor analyst staff simply recognized what they imagine are the (*3*) for buyers to purchase now… and Rivian Automotive wasn’t considered one of them. The 10 shares that made the lower might produce monster returns in the approaching years.

Consider when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $716,988!*

Stock Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Ryan Vanzo has no place in any of the shares talked about. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

If You'd Invested $150 in Rivian Stock 3 Years Ago, Here's How Much You'd Have Today was initially revealed by The Motley Fool