Warren Buffett and Ken Griffin are two of probably the most revered traders in the world, however their paths to monetary success are very totally different.

Buffett is a long-term worth investor who focuses on shopping for essentially robust, undervalued corporations and holding them for lengthy intervals to profit from compounding development. In distinction, Citadel founder Ken Griffin employs a extra lively, quantitative, and data-driven strategy, exploiting market inefficiencies to generate massive returns.

But generally their totally different methods make them the identical conclusions. And when two such storied traders are seen getting behind the identical corporations, it deserves some investigation into the explanation why.

Recently, each have been loading up on shares of Sirius XM (NASDAQ:SIRI) and Ulta Beauty (NASDAQ:ULTA), so naturally we’ve determined to present these names a nearer look.

With some help from the TipRanks database, we are able to get an concept of whether or not the Street’s analyst group thinks these shares make for good picks in the present atmosphere. Let’s dive in.

Sirius XM Holdings

First up on our Buffett/Griffin endorsed record is Sirius XM, a main supplier of satellite tv for pc radio and on-line streaming companies. The firm presents a broad spectrum of programming, together with music, sports activities, information, and leisure, serving thousands and thousands of subscribers throughout North America through greater than 150 channels, with unique content material similar to dwell sports activities, speak exhibits, and curated music stations. Over the years, it has additionally expanded its attain by means of digital platforms, enabling customers to stream content material on-line and through its cellular app.

Formed through the merger of Sirius Satellite Radio and XM Satellite Radio in 2008, the corporate has turn into the dominant participant in the satellite tv for pc radio business. The most up-to-date SIRI information additionally revolves round a merger. Earlier this week, the corporate introduced that it had finalized its merger with Liberty Media’s Sirius XM monitoring inventory, ensuing in what the corporate has known as a “simplified capital structure and strategy.” The newly mixed entity will preserve the Sirius XM model, and buying and selling commenced after a much-anticipated reverse inventory break up.

Along with the announcement, the corporate additionally reiterated its income and adjusted EBITDA outlook for the 12 months, nonetheless anticipating $8.75 billion and round $2.7 billion, respectively, whereas free money circulation is predicted to succeed in $1.0 billion.

Meanwhile, each Buffett and Griffin seem like followers. In Q2, Buffett’s Berkshire Hathaway improved its SIRI place by 18% with the addition of ~15.43 million shares. The firm now holds greater than 101.38 million shares, value $2.87 billion. Griffin’s stake is extra modest; he holds ~5.1 million shares, which command a market worth of ~$144 million.

Also laying out the bull case for the brand new look Sirius, Seaport Global David Joyce highlights how the massive merger might be useful for the corporate and the inventory.

“The long road to collapsing the Liberty Media control ownership into SIRI has reached its end. After what appears to be idiosyncratic deal-related trading pressures on SIRI shares, we think the single-class, single-corporate structure of New Sirius should significantly enhance trading liquidity from here and simplify the story, which could broaden the shareholder base and possibly improve sentiment and valuation,” Joyce opined.

“We like the stable business model with sticky satellite radio subscribers, a growing podcasting services and advertising business, and a manageable/modest decline in the Pandora business. The company is in the early innings of pushing its streaming service, as a strategy to attract and retain a younger user base,” Joyce went on so as to add.

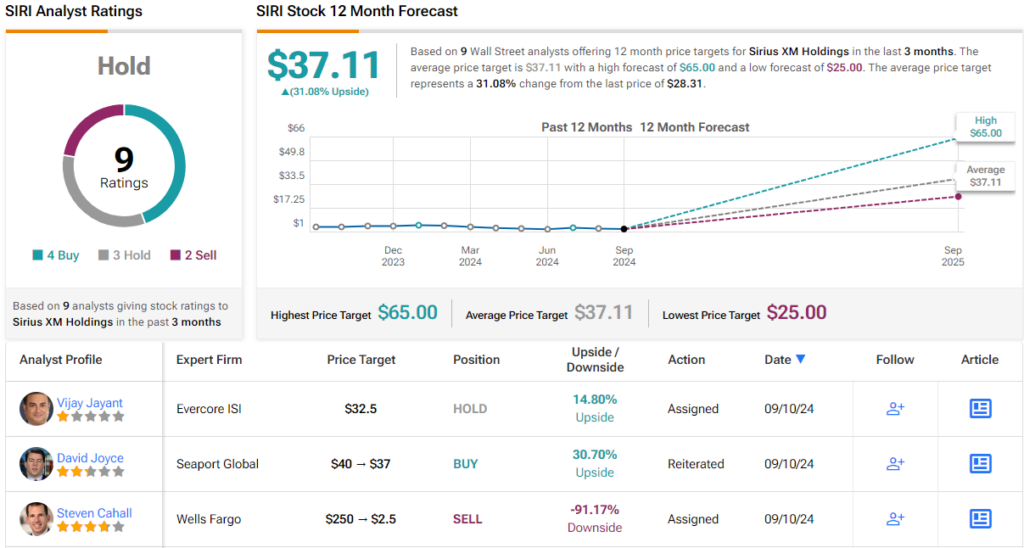

Quantifying his stance, Joyce charges SIRI shares as a Buy whereas his $37 value goal leaves room for 12-month returns of ~31%. (To watch Joyce’s monitor report, click on right here)

Joyce’s goal is roughly the identical because the Street’s common goal, though the rankings inform a little bit of a totally different story. The inventory solely claims a Hold consensus score, based mostly on a mixture of 4 Buys, 3 Holds and 2 Sells. (See SIRI inventory forecast)

Ulta Beauty

Next up, is Ulta Beauty, a U.S. retailer providing a wide selection of magnificence merchandise, together with cosmetics, skincare, haircare, and fragrances, alongside salon companies. Since being established in 1990, the corporate has grown to function over 1,300 shops throughout the U.S., offering a mixture of status, mass, and salon-quality manufacturers below one roof. Its product lineup options each well-known luxurious names and inexpensive drugstore choices, thereby catering to a vast demographic of customers.

On prime of its retail presence, Ulta Beauty has a robust on-line platform and loyalty program, which helps enhance buyer engagement and gross sales development. The firm additionally emphasizes inclusivity and sustainability and promotes eco-conscious magnificence initiatives.

All that generated income of $2.6 billion in the corporate’s fiscal second quarter, which represented a 4% year-over-year improve though the determine missed the forecast by $10 million. Likewise on the different finish of the spectrum, EPS of $5.30 fell $0.15 in need of the analysts’ goal.

Those outcomes didn’t assist the inventory, which in whole has misplaced 24% thus far this 12 months.

Buffett and Griffin, nevertheless, should really feel the corporate is poised for additional success. In truth, throughout Q2, Buffett opened a new place with the acquisition of 690,106 ULTA shares. These are at the moment value nearly $257 million. Meanwhile, Griffin elevated his holdings by 267% with the acquisition of just about 96,000 shares. His whole holdings now stand at 131,713 shares, which on the present value are value ~$49.2 million.

While Loop Capital’s Anthony Chukumba acknowledges the tough atmosphere Ulta operates in, he believes the corporate is robust sufficient to resist the headwinds.

“While we think it will take Ulta Beauty time to adjust to the ‘new normal’ competitive landscape, we believe the company’s formidable business model (e.g., prestige and mass products, strong customer loyalty program, robust omni channel offering, in-store salons) will eventually shine through,” the 5-star analyst defined.

“Management reiterated the following initiatives intended to regain market share: (1) strengthening the merchandise assortment; (2) enhancing the company’s social media relevance (including doubling the size of the company’s influencer network); (3) improving the digital experience, including enhancing search and product filtering; (4) further leveraging the Ulta Beauty Rewards loyalty program, including adding member-only events; and (5) evolving promotional levers,” Chukumba famous.

These feedback underpin Chukumba’s Buy score, which is backed by a $450 value goal. This determine presents a 12-month upside of ~21%. (To watch Chukumba’s monitor report, click on right here)

Turning now to the remainder of the Street, the place based mostly on an extra 9 Buys, 7 Holds and 1 Sell, the inventory receives a Moderate Buy consensus score. Going by the $467.82 common goal, a 12 months from now, the shares shall be altering arms for a ~26% premium. (See ULTA inventory forecast)

To discover good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed in this text are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is essential to do your individual evaluation earlier than making any funding.