2021 looks as if a very long time in the past as a result of a lot has occurred since. But simply three years in the past, financial stimulus despatched shares to the moon, solely to come back crashing again to Earth in 2022. Enthusiastic buyers pushed inventory valuations by means of the roof. For instance, the common lending platform Upstart Holdings peaked with a market cap of $32 billion, buying and selling for a whopping 48 instances gross sales. The firm is value $3.7 billion right this moment with a extra modest valuation of seven instances gross sales. Upstart wasn't value the premium; nonetheless, some firms are.

Amazon has traded with a premium valuation for many years, and buyers have been richly rewarded to the tune of seven,000% over 20 years. But what about Palantir (NYSE: PLTR)? Is its premium valuation warranted?

There's quite a bit to love

When Palantir inventory traded for lower than $10 per share in 2022, buyers criticized the firm for being unprofitable, utilizing an excessive amount of stock-based compensation, and struggling to develop commercially. These issues have been put to relaxation. Here are the charts that inform the story.

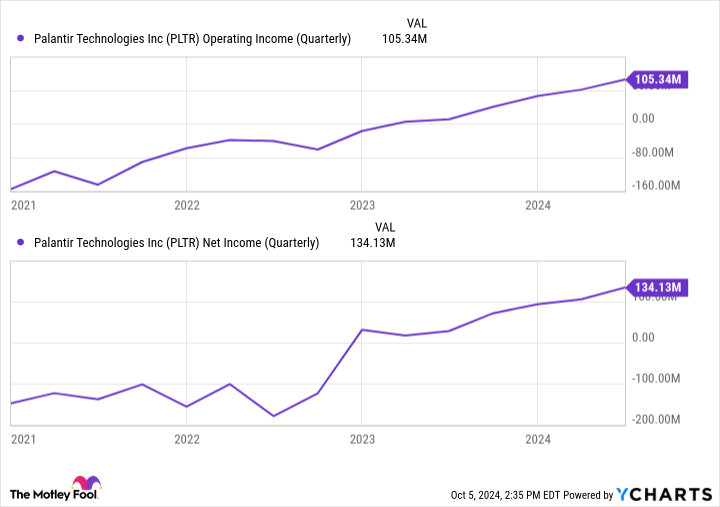

Palantir reported file working and web revenue in the second quarter of 2024. As you'll be able to see beneath, each have risen steadily and considerably.

The $134 million in web revenue got here on a formidable 20% margin, whereas the working margin was 16%, which can be stable and rising quick.

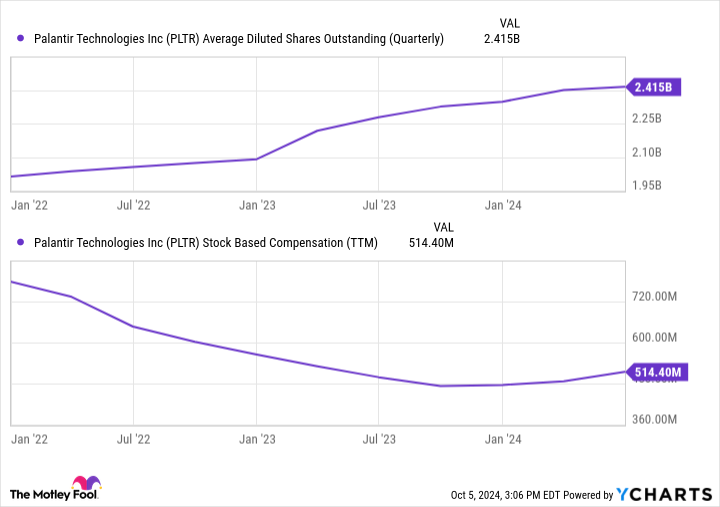

Stock-based compensation (SBC), which dilutes current shareholders by growing the variety of shares accessible, is declining. As depicted beneath, the enhance in excellent shares has largely leveled off as SBC has declined.

The decline is even starker when measured as a share of income. SBC for the final 12 months was 20% of gross sales; it was 33% in 2022.

Finally, the firm's enhance in business clients and gross sales is spectacular. Palantir launched its synthetic intelligence (AI) platform AIP and is promoting it aggressively. The program aggregates information from a number of sources and permits customers to make use of the information to make smarter choices. For occasion, a distribution firm that expects downtime in a single location (maybe extreme climate is forecast) can use AIP to find out the greatest options to get clients merchandise in addition to the impression on income and margins.

Commercial income hit $307 million in Q2 with 33% year-over-year general progress and 55% progress in the United States. Government gross sales had been additionally robust, at $371 million, with 23% progress.

It's straightforward to see why buyers are exuberant, however has it gone too far?

Palantir buyers needs to be cautious

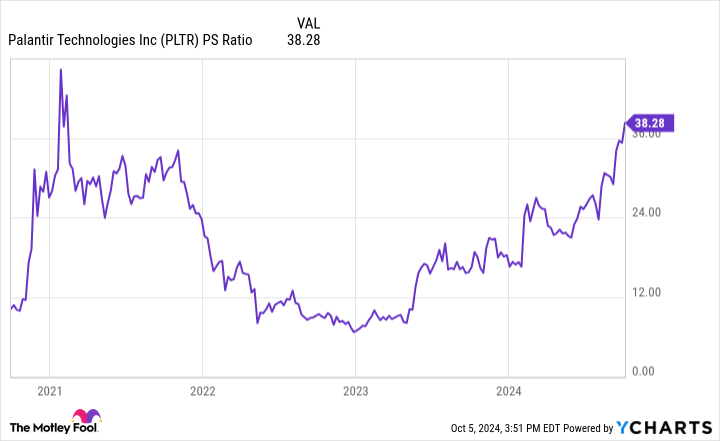

Palantir inventory has elevated 520% since the starting of 2023, reaching an all-time excessive of $40 per share. Investors who purchased again then are sitting on terrific features, however new buyers needs to be extraordinarily cautious. The price-to-sales ratio, proven beneath, is approaching 2021 tech bubble ranges and is considerably larger than that of different fast-growing tech firms.

CrowdStrike and Cloudflare are cheap comparisons as in addition they have gross margins over 75% and income progress of 30% or extra. They commerce for 21 and 19 instances gross sales, respectively. CrowdStrike's valuation peaked at 29 instances gross sales earlier than the outage incident.

To put it in perspective, Palantir would want to develop its 2023 gross sales at the present charge of 27% by means of the finish of 2026 earlier than the valuation would drop to twenty instances gross sales at the present worth. Even if the firm executes flawlessly and the inventory market and financial system stay robust, buyers nonetheless do not have a margin of security. If 2021 taught us something, it is that valuations do matter in the long term. Palantir is a good firm, however the worth is simply too excessive for my cash.

Don’t miss this second likelihood at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for the most profitable shares? Then you’ll need to hear this.

On uncommon events, our professional workforce of analysts points a “Double Down” stock advice for firms that they suppose are about to pop. If you’re nervous you’ve already missed your likelihood to speculate, now's the greatest time to purchase earlier than it’s too late. And the numbers communicate for themselves:

Amazon: should you invested $1,000 after we doubled down in 2010, you’d have $21,006!*

Apple: should you invested $1,000 after we doubled down in 2008, you’d have $42,905!*

Netflix: should you invested $1,000 after we doubled down in 2004, you’d have $388,128!*

Right now, we’re issuing “Double Down” alerts for 3 unbelievable firms, and there might not be one other likelihood like this anytime quickly.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of administrators. Bradley Guichard has positions in Amazon and CrowdStrike. The Motley Fool has positions in and recommends Amazon, Cloudflare, CrowdStrike, Palantir Technologies, and Upstart. The Motley Fool has a disclosure policy.

Palantir Stock: Is the Incredible Valuation Justified? was initially printed by The Motley Fool