Top traders can change into legends, and few have achieved such standing like Izzy Englander, the mastermind behind Millennium Management, a hedge fund boasting $69 billion in property. Since launching in 1989, Englander has managed to show a revenue each single yr – apart from 2008 in the course of the monetary disaster. It’s a exceptional achievement, and one which traders can be taught from.

By observing Englander’s inventory strikes, each those he buys and sells, we are able to achieve priceless insights. A assessment of his Q2 transactions reveals a selected curiosity in AI shares, with a spotlight on trade leaders like Palantir (NYSE:PLTR) and Super Micro Computer (NASDAQ:SMCI).

Let’s dive deeper into these picks and discover the reasoning behind Englander’s newest strikes. With assist from the TipRanks database, we are able to additionally learn the way the Street’s analyst group feels about his selections.

Palantir

The first inventory on our listing is Palantir Technologies, a high-tech agency co-founded in 2003 by the tech-inspired enterprise capitalist Peter Thiel. Thiel, additionally the co-founder of PayPal, isn't any stranger to revolutionary tech – and Palantir has all the time centered on bringing innovation to the sector of knowledge evaluation. Today, Palantir works to mix each AI and human instinct, bringing the very best of each realms to bear on knowledge analytics – and making the sector stronger in consequence. That aim has benefited enormously from the appearance of current AI technical advances.

Palantir provides a variety of services, designed to enhance analytics through the use of AI tech to complement human experience. The firm’s platform, AIP, lets customers work together of their mom tongues, utilizing an AI-powered pure language processor behind the interface. This is a significant advance, as Palantir subscribers don't want experience in coding or laptop language to make use of the system; directions could be entered in plain language, and outcomes learn out the identical approach.

These AI-powered analytic merchandise have discovered use in a variety of fields, together with knowledge safety, monetary providers, anti-money laundering and fraud safety, healthcare and hospital operations, authorities providers – the listing is lengthy. Palantir’s use of AI and pure language permits customers to comprehend the advantages of the system instantly on set up.

Palantir has benefitted immensely from the AI-driven bull market. Year-to-date, the inventory has dramatically outperformed the broader markets, gaining 133% – in comparison with the 20.5% ytd achieve on the S&P 500 index.

On the monetary facet, Palantir’s final earnings report – protecting 2Q24 – confirmed a prime line of $678 million, for 27% year-over-year development and a few $25 million-plus above the forecast. At the underside line, the corporate listed earnings of 9 cents per share by non-GAAP measures, up 80% year-over-year and a penny higher than anticipated. During the quarter, Palantir’s buyer depend confirmed y/y development of 41%, and the corporate closed a powerful 27 offers valued at $10 million or extra.

And but, with all of that, Izzy Englander bought off greater than 7 million shares of PLTR in the course of the second quarter, decreasing his stake by nearly 60%. The billionaire hedge supervisor nonetheless holds greater than 4.97 million shares in Palantir, valued at over $193 million.

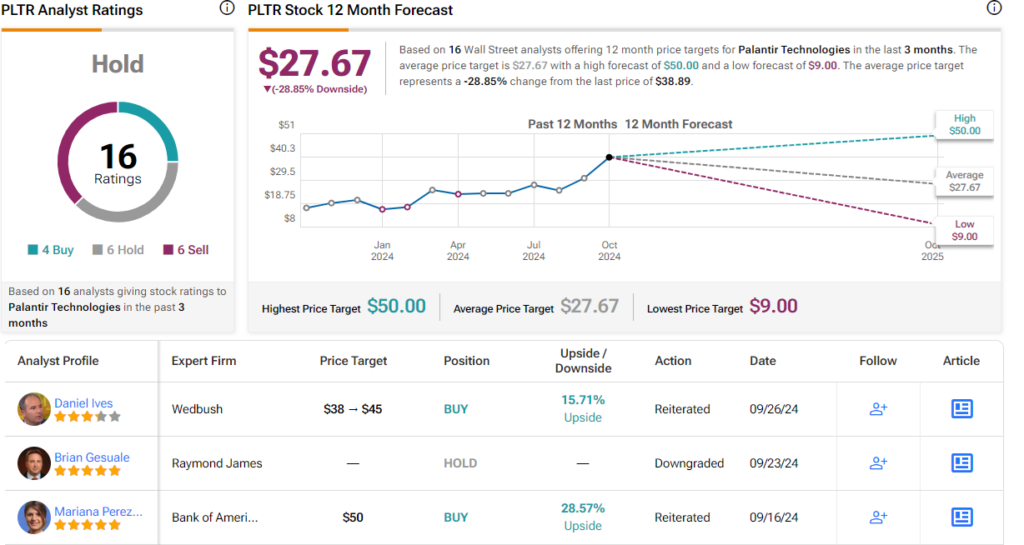

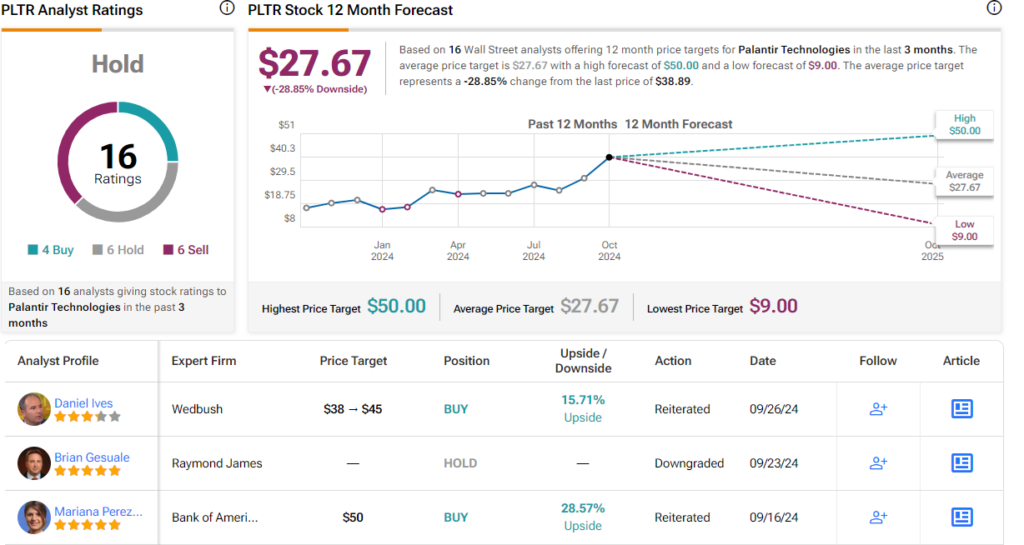

5-star analyst Brian Gesuale, of Raymond James, might shed some mild on why Englander would shed a holding in such an clearly profitable firm. In his current protection of Palantir, Gesuale downgrades his stance right here, saying of the inventory, “While we remain enthusiastic about Palantir’s longer term positioning in AI, we are downgrading our rating to Market Perform from Outperform given our view that shares need to consolidate stellar gains over the last couple of years… Valuation has expanded ~fivefold making it the richest software name amongst comps at 26.1x FY25 sales.”

The downgrade to Market Perform (Neutral) isn't accompanied by a brand new value goal; Raymond James is stepping again to see how this inventory shakes out going ahead. (To watch Gesuale’s monitor document, click on right here)

Overall, that is according to the Street’s view of PLTR shares. The inventory has a Hold consensus score, primarily based on 16 evaluations that embrace 4 Buys and 6 Holds and Sells, every. The shares are priced at $38.89 and their $27.67 common goal value implies a contraction over the approaching yr, of 29%. (See Palantir inventory forecast)

Super Micro Computer

Next on the listing is a frontrunner in AI {hardware}, Super Micro Computer. Discussions of AI tech often revolve across the software program and the platform interfaces, making it simple to lose sight of the truth that laptop techniques run on superior {hardware} – high-performance computer systems, large-scale server stacks, and solid-state reminiscence techniques. Without these, we wouldn’t have AI. With them, we not solely can help AI, however different superior techs as effectively, equivalent to cloud computing, knowledge facilities, edge computing, and 5G networking. Super Micro Computer is a frontrunner within the growth and build-outs of those top-end laptop {hardware} techniques.

With greater than 30 years’ expertise in high-tech, Super Micro has set itself up because the go-to place for high-end computing. The firm boasts that it could possibly design and construct advanced server stacks and high-performance computer systems to distinctive specs in-house and might set up such techniques at any scale for any utility. Super Micro fills these orders with each off-the-shelf components and custom-made gadgets, and might meet each one-off design requests and large-scale orders. The firm’s manufacturing footprint is giant, and is able to a excessive stage of manufacturing – as much as 5,000 AI, HPC, and liquid cooling rack options per thirty days.

Like Palantir above, Super Micro has realized stable advantages from the AI growth of current years. The firm’s product traces, particularly the high-performance computer systems and superior server stacks, are well-suited to supporting AI know-how and the info facilities it relies upon on. As effectively, the corporate’s skill to offer custom-made, high-capacity reminiscence techniques can be amenable to AI makes use of and purposes.

On the headwind facet, nevertheless, Super Micro has seen some critical current points crop up. At the top of September, the corporate turned the topic of a Justice Department investigation into potential accounting violations, and in relation to that notified the NASDAQ that it is going to be late in submitting its 10-Ok for the second quarter. Super Micro has acquired a non-compliance notification letter from NASDAQ in regard to the missed submitting deadline.

Meanwhile, Super Micro nonetheless went forward with its scheduled 10-to-1 inventory cut up on October 1. On that date, present shareholders of document noticed their holdings improve by an element of 10, and the share value was decreased accordingly.

Looking on the firm’s monetary outcomes, we discover that Super Micro reported 2Q24 revenues – the final quarter reported – of $5.3 billion. That represented a powerful 143% year-over-year bump, and got here in a modest $10 million over the forecast. The non-GAAP earnings, in pre-split numbers, had been set at $6.25 per share, lacking the forecast by $1.56 per share.

In the midst of all of this, Izzy Englander should have a bullish view of SMCI’s prospects. He bought over 5.5 million shares of SMCI throughout Q2, considerably growing his stake. His present holding within the inventory stands at 6,219,170 shares, price nearly $297 million.

In his protection of Super Micro for Needham, top-tier analyst Quinn Bolton sees the corporate’s AI publicity as key. He says of the agency and its inventory, “As a first mover in the design of GPU-based compute systems and liquid cooled rack level solutions, we view Supermicro as a significant beneficiary from growing investment in AI infrastructure and forecast a revenue CAGR in excess of 55% from FY21 to FY26. Supermicro is currently involved in the deployment of some of the largest AI clusters in the world and entered FY25 with record high backlog.”

Looking forward, Bolton goes on to clarify why the risk-reward is favorable right here, including, “Though we model a GM recovery more conservative than management’s forecast, we believe the bear case that GM will trend towards the single digits is too pessimistic. Also, while we acknowledge the risk associated with the Board’s review of internal controls, we believe most of this risk may already be reflected in the current share price.”

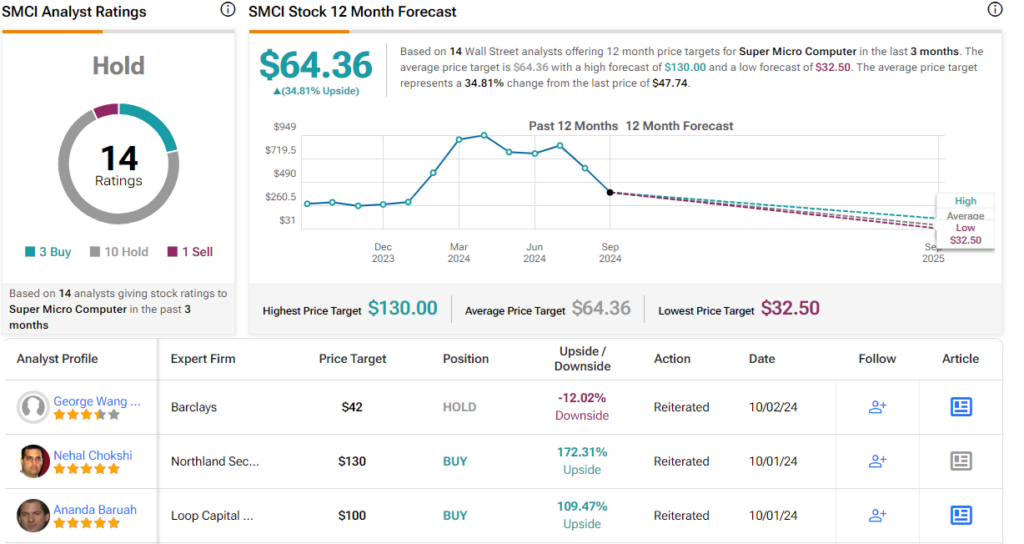

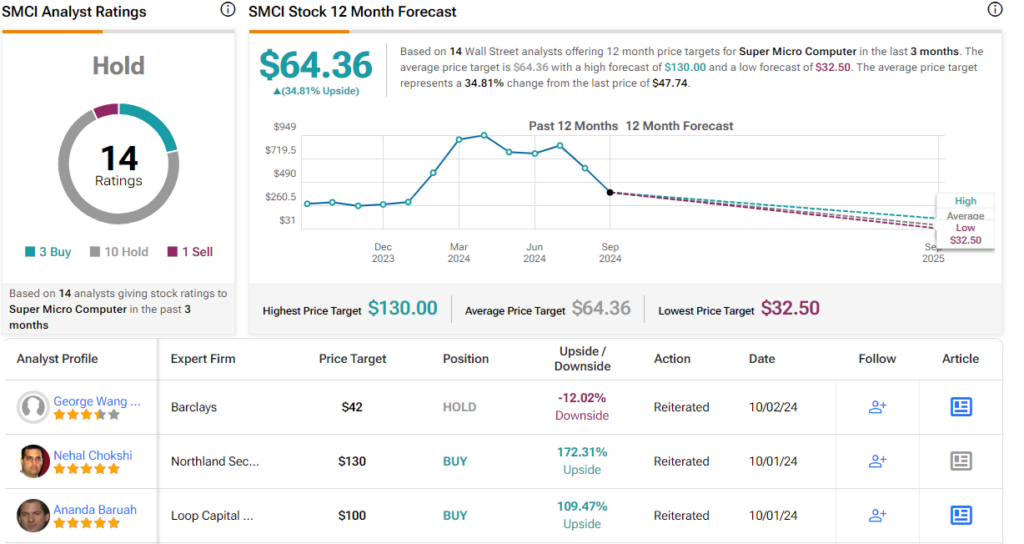

Together, these feedback again up Bolton’s Buy score on SMCI shares; his value goal, adjusted post-split to $60, implies a one-year upside potential of 26%. (To watch Bolton’s monitor document, click on right here)

That’s the bullish take. The Street view is considerably blended right here, nevertheless, and the inventory has a Hold score primarily based on 14 evaluations with a breakdown of three Buys, 10 Holds, and 1 Sell. However, some analysts stay relatively bullish; as such, the common goal value of $64.36 means that SMCI will achieve 35% over the subsequent yr. (See SMCI inventory forecast)

To discover good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is essential to do your individual evaluation earlier than making any funding.