No occasion is extra anticipated by Social Security's greater than 68 million beneficiaries than the annual reveal of the cost-of-living adjustment (COLA). That's as a result of most retirees want their month-to-month Social Security verify, in some capability, to cowl their bills.

For greater than twenty years, Gallup has performed annual surveys that gauge retirees' reliance on Social Security as an revenue supply. This 12 months, for example, 88% of retirees famous it represented a “major” or “minor” revenue supply, with solely 11% responding that it was pointless. In different phrases, most Americans would doubtless wrestle with out the monetary basis Social Security supplies.

In simply 11 days — Oct. 10 is the magic date to circle on your calendar — Social Security's 2025 COLA will probably be unveiled. With a number of forecasts now in settlement as to the dimensions of this COLA, we will now estimate how a lot the typical verify is anticipated to rise subsequent 12 months.

Social Security's COLA serves an necessary objective

Before digging into the nitty-gritty of how a lot Social Security advantages are set to climb in 2025, it is fairly necessary to perceive what objective the cost-of-living adjustment serves.

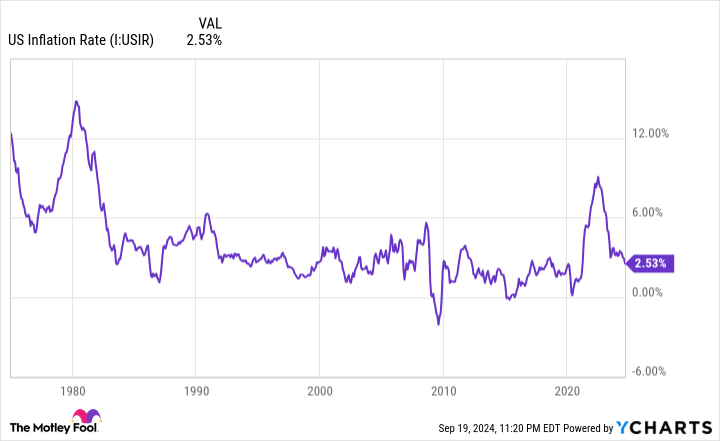

In a utopian world, the value we pay for items and companies would by no means change, and beneficiaries would not have to fear about their Social Security revenue dropping shopping for energy. But in the true world, the value of virtually every little thing we purchase fluctuates over time, and infrequently heads greater. Social Security's COLA is tasked with guaranteeing that beneficiaries do not lose buying energy over time.

From the primary mailed retired-worker verify in January 1940 by way of December 1974, there wasn't a set system for assigning COLAs. Rather, arbitrary classes of Congress handed alongside COLAs from time to time. Following no changes within the Forties, a record-breaking 77% COLA was handed in 1950.

Beginning in 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) took its place because the inflationary instrument used to calculate annual COLAs. The CPI-W takes under consideration the value change of greater than 200 items and companies, every of which have their very own respective proportion weightings. These weightings enable the CPI-W to be expressed as a single determine every month and make for straightforward month-to-month and year-over-year comparisons.

Despite the CPI-W being reported month-to-month, solely trailing-12-month readings in the course of the third quarter (Q3), July by way of September, issue into Social Security's COLA calculation. Put merely, if the typical CPI-W studying in Q3 of the present 12 months is greater than the comparable interval final 12 months, costs have collectively risen (i.e., inflation). When this occurs, advantages enhance the next 12 months.

The magnitude of this enhance is solely the year-over-year proportion change in common Q3 CPI-W readings, rounded to the closest tenth of a p.c.

Here's how a lot Social Security checks are set to climb in 2025

Forecasts for Social Security's 2025 cost-of-living adjustment started at reverse ends of the spectrum this 12 months.

In January, the Senior Citizens League (TSCL), a Virginia-based nonpartisan senior advocacy group, estimated Social Security's 2025 COLA can be a disappointing 1.4%. But after quite a few updates, TSCL is now forecasting a 2.5% cost-of-living adjustment for 2025.

On the opposite hand, unbiased Social Security and Medicare coverage analyst Mary Johnson, who not too long ago retired from TSCL, was forecasting a comparatively strong 3.2% COLA following the April inflation report. However, this estimate has declined with every subsequent report and now sits at a TSCL-matching 2.5% for 2025.

Although nothing is ready in stone — the September inflation report is the ultimate puzzle piece wanted to definitively calculate Social Security's 2025 COLA — each main forecasts are in settlement on a 2.5% COLA for the upcoming 12 months.

But percentages solely inform a part of the story. With the belief that TSCL's and Johnson's forecasts show correct, let's take a more in-depth take a look at how a lot the typical Social Security verify is anticipated to rise in 2025. For this train, I'll be utilizing common payouts for the month of August.

Based on information from the Social Security Administration, the typical profit doled out to its greater than 68 million recipients in August was $1,783.55. A 2.5% COLA would outcome within the common verify growing by $44.59 monthly subsequent 12 months.

But this enhance may differ considerably, relying on the kind of beneficiary:

The common retired-worker beneficiary can anticipate their month-to-month verify to rise by $48.01 to $1,968.49 with a 2.5% cost-of-living adjustment in 2025.

For employees with disabilities, a 2.5% COLA would enhance the typical month-to-month profit by $38.50 monthly to $1,578.42.

Survivor beneficiaries ought to see their common month-to-month payout climb by $37.73 to $1,547.09 with a 2.5% COLA.

Although this might signify the smallest COLA on a proportion foundation since 2021, it is nonetheless above the two.3% common COLA handed alongside during the last 15 years.

Social Security's COLAs aren't reducing it for many retirees

Although beneficiaries are on observe to obtain one other (on paper) first rate COLA following shut to a decade of disappointment — no COLAs had been handed alongside in 2010, 2011, and 2016 due to deflation, and the smallest optimistic COLA on report was administered in 2017 (0.3%) — the truth for a majority of retirees is that Social Security's COLAs aren't reducing it in contrast to the inflationary pressures they're contending with.

Based on information from the August inflation report, shelter and medical care service prices have risen by 5.2% and three.2%, respectively, over the trailing 12 months. Both these bills matter significantly extra to seniors than the standard working American, they usually're growing at a notably sooner fee than the estimated 2025 COLA.

With the CPI-W targeted on the spending habits of “urban wage earners and clerical workers,” who are sometimes working-age Americans not at present receiving a Social Security profit, the stage is ready, most of the time, for Social Security advantages to lose shopping for energy.

In mid-July, TSCL printed an evaluation that discovered the buying energy of a Social Security greenback had declined by 20% for the reason that begin of 2010. Further, the prevailing inflation fee for a given 12 months has outpaced its assigned COLA in 10 of the final 15 years.

Making issues worse, Medicare's Part B premium is anticipated to have yet one more scorching-hot enhance in 2025. Part B is the part of Medicare answerable for outpatient companies.

According to the Medicare Trustees Report, the Part B premium is forecast to rise by 5.9% in 2025 to $185 monthly, which might match the 5.9% hike handed alongside this 12 months. A majority of retired employees aged 65 and over (i.e., the eligibility age for Medicare enrollment) have their Part B premiums robotically deducted from their month-to-month Social Security verify.

If Part B rises at greater than twice the speed of the 2025 COLA, it is a veritable certainty that the majority retirees will see not less than a few of their cost-of-living adjustment negated.

Yes, Social Security advantages are set to climb in 2025, however the associated fee to retirees continues to be far better than any reward.

The $22,924 Social Security bonus most retirees utterly overlook

If you are like most Americans, you are just a few years (or extra) behind on your retirement financial savings. But a handful of little-known “Social Security secrets” may assist guarantee a lift in your retirement revenue. For instance: one simple trick may pay you as a lot as $22,924 extra… annually! Once you find out how to maximize your Social Security advantages, we expect you may retire confidently with the peace of thoughts we're all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

Social Security's 2025 Cost-of-Living Adjustment (COLA) Forecasts Are in Agreement — Here's How Much the Average Check Is Expected to Rise Next Year was initially printed by The Motley Fool