For newbies, it might seem to be a good thought (and an thrilling prospect) to purchase a firm that tells a good story to buyers, even when it at present lacks a observe file of income and revenue. But the fact is that when a firm loses cash annually, for lengthy sufficient, its buyers will normally take their share of these losses. While a nicely funded firm might maintain losses for years, it's going to want to generate a revenue ultimately, or else buyers will transfer on and the corporate will wither away.

In distinction to all that, many buyers want to give attention to firms like Constellation Energy (NASDAQ:CEG), which has not solely revenues, but in addition earnings. Even if this firm is pretty valued by the market, buyers would agree that producing constant earnings will proceed to present Constellation Energy with the means to add long-term worth to shareholders.

See our newest evaluation for Constellation Energy

Constellation Energy's Improving Profits

Even when EPS earnings per share (EPS) development is unexceptional, firm worth might be created if this fee is sustained annually. So it is no shock that some buyers are extra inclined to put money into worthwhile companies. It is awe-striking that Constellation Energy's EPS went from US$2.36 to US$7.65 in only one yr. Even although that development fee might not be repeated, that appears like a breakout enchancment.

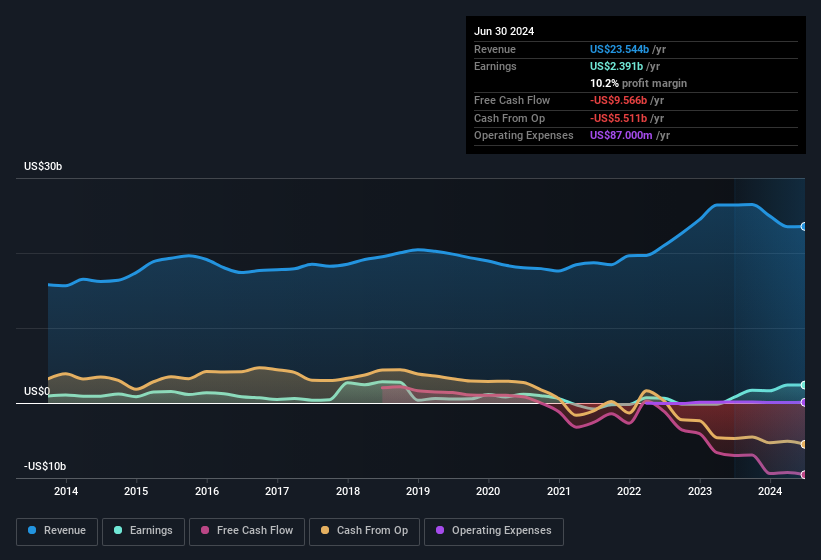

It's usually useful to take a have a look at earnings earlier than curiosity and tax (EBIT) margins, in addition to income development, to get one other tackle the standard of the corporate's development. Constellation Energy's EBIT margins have really improved by 10.3 proportion factors within the final yr, to attain 12%, however, on the flip aspect, income was down 11%. That's not a good look.

In the chart under, you possibly can see how the corporate has grown earnings and income, over time. To see the precise numbers, click on on the chart.

Fortunately, we have entry to analyst forecasts of Constellation Energy's future earnings. You can do your individual forecasts with out trying, or you possibly can take a peek at what the professionals are predicting.

Are Constellation Energy Insiders Aligned With All Shareholders?

Owing to the scale of Constellation Energy, we would not anticipate insiders to maintain a important proportion of the corporate. But thanks to their funding within the firm, it is pleasing to see that there are nonetheless incentives to align their actions with the shareholders. Holding US$87m price of inventory within the firm is no laughing matter and insiders will likely be dedicated in delivering the perfect outcomes for shareholders. This ought to preserve them centered on creating long run worth for shareholders.

Is Constellation Energy Worth Keeping An Eye On?

Constellation Energy's earnings per share have been hovering, with development charges sky excessive. That form of development is nothing wanting eye-catching, and the big funding held by insiders ought to actually brighten the view of the corporate. The hope is, after all, that the sturdy development marks a basic enchancment within the enterprise economics. So on the floor degree, Constellation Energy is price placing in your watchlist; in spite of everything, shareholders do nicely when the market underestimates quick rising firms. Even so, bear in mind that Constellation Energy is displaying 2 warning indicators in our funding evaluation , you must find out about…

Although Constellation Energy actually appears to be like good, it might enchantment to extra buyers if insiders had been shopping for up shares. If you want to see firms with extra pores and skin within the recreation, then try this handpicked number of firms that not solely boast of sturdy development however have sturdy insider backing.

Please observe the insider transactions mentioned on this article refer to reportable transactions within the related jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every single day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High development Tech and AI Companies

Or construct your individual from over 50 metrics.

Explore Now for Free

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn't represent a suggestion to purchase or promote any inventory, and doesn't take account of your targets, or your monetary scenario. We goal to deliver you long-term centered evaluation pushed by basic knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.